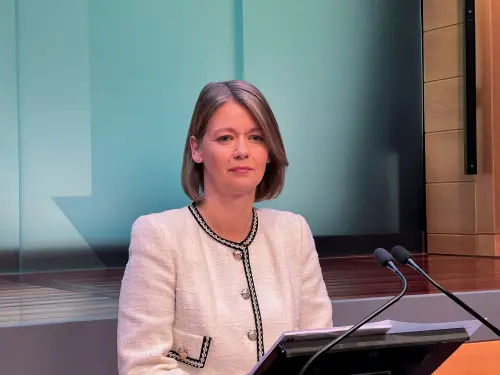

In Oslo on February 13, Norway's central bank is on the brink of its first interest rate cut in five years, according to Norges Bank governor, Ida Wolden Bache. While inflation remains a consideration, she indicated that a slightly more relaxed monetary policy is imminent, albeit maintaining a comparatively elevated borrowing cost.

Norges Bank stands apart from other Western central banks which eased rates in response to slowing growth and decreasing inflation last year. Bucking this trend, Norges Bank has held its benchmark rate at 4.50%, a 17-year high, with plans to potentially reduce it next month.

Bache mentioned in her annual speech to business leaders and government officials, "We are nearing a point where we can slightly loosen monetary policy, yet a cautious approach remains crucial." She also warned that an elevated interest rate level may be necessary compared to previous years.

Norway last saw a rate reduction in May 2020, with subsequent increases totaling 14 increments of a quarter percentage point each. Initial forecasts suggested three rate cuts to 3.75% by 2025, but these projections are subject to revision in the upcoming policy announcement on March 27.

Despite an unexpected uptick in January's core inflation to 2.8%, slightly surpassing the 2.0% target, economists believe this may limit the potential for rate reductions.

Governor Bache expressed concerns about the adverse effects of global protectionism, citing potential economic impacts from escalating trade conflicts. The uncertainty surrounding global trade developments makes it challenging to predict how this will influence Norwegian inflation and interest rates.

In a noteworthy proposal, policymakers are contemplating revising the ethical guidelines of Norway's $1.8 trillion wealth fund, potentially allowing investments in major arms manufacturers.