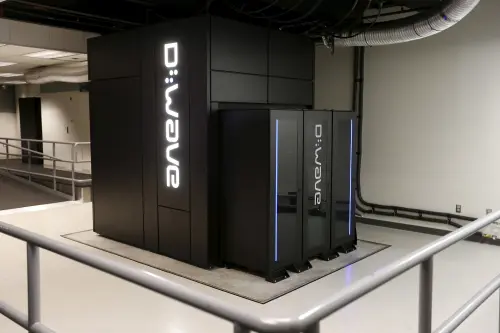

Shares of select quantum computing companies surged on Thursday in New York, outperforming the broader market, buoyed by a positive revenue forecast by D-Wave Quantum. This optimism stems from expectations that their quantum computers, leveraging quantum mechanics, deliver superior speed and efficiency compared to classical computers. D-Wave Quantum's shares rose by 15% to $6.71, following an upbeat quarterly forecast that exceeded analysts' estimates.

Quantum Corp saw a notable 26% increase, marking its largest daily gain since mid-February, while Quantum Computing Inc rose by 2%. In contrast, the Nasdaq composite dipped over 2% during afternoon trading.

The innovation and potential of quantum computing have sparked investor interest, with Longbow Asset Management's CEO, Jake Dollarhide, noting its escalating allure on Wall Street. He emphasized the growing importance of the sector, comparing it to the early stages of artificial intelligence development.

Notably, Microsoft's recent introduction of a new quantum chip has ignited discussions regarding the technology's future. Dollarhide indicated his involvement in the field through the Defiance Quantum exchange-traded fund, which experienced a minor decrease of 0.8% on Thursday.

Amidst the overall market uptrend, IonQ witnessed a 5.3% decline to $20.68 due to Kerrisdale Capital's short position declaration. Despite a 2024 surge of over 200%, IonQ's stock has fallen approximately 50% year-to-date.