Introduction

Hims & Hers Health is positioning itself to capitalize on the cash-pay market for weight-loss drugs amid a shifting competitive landscape in the U.S. However, analysts are urging the company to adapt to changing market conditions.Context

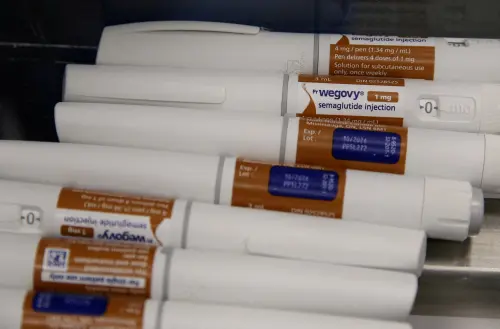

Hims has found success with more affordable compounded versions of popular weight-loss medications, such as Novo Nordisk's Wegovy, particularly when the U.S. Food and Drug Administration (FDA) allowed these alternatives during shortages. As supply issues have resolved, the FDA has mandated that sales of compounded versions be curtailed.Developments

Michael Cherny, a healthcare analyst at Leerink, noted that with the semaglutide shortage over, Hims must pivot its growth model to leverage other products in its weight-management program. Following the FDA's deadline, Hims shares plummeted 14% within a week, contributing to an overall 18% decline from their February peak.Currently, Hims is offering "personalized" dosages of Wegovy starting at around $165 a month, justified under clinical guidelines to mitigate side effects. The company has also introduced liraglutide, a generic counterpart to an older Novo diabetes drug that additionally promotes weight loss, alongside branded Wegovy and Eli Lilly's Zepbound.

Despite these offerings, analysts remain skeptical about the legitimacy of the "personalized" claims and whether Novo Nordisk will condone Hims’ practices, especially since the company has warned against illegal replication of its products.

Additionally, competitors like Ro and Noom have established partnerships with insurers, a strategy Hims is not currently pursuing. Cherny emphasized that any expansion of insurance coverage for these medications would diminish demand for cash-pay options, potentially hindering Hims' growth.

Hims has ambitious plans, projecting $6.5 billion in revenue by 2030, with estimates of $2.4 billion for 2025, an increase from $1.5 billion in 2024.

CEO Andrew Dudum indicated that many consumers resort to cash-pay options due to excessively high insurance deductibles for weight-loss medications. The company is aiming to serve under-insured consumers and has recently acquired a diagnostic lab to assist in identifying potential patients. New services include treatments for low testosterone and menopause, and the company is also expanding into the UK and Europe.

However, Hims's continued sale of compounded semaglutide may threaten a recently formed partnership that enables its subscribers to access Novo Nordisk’s direct-pay pharmacy, NovoCare, raising concerns about possible litigation from the Danish drugmaker, which has initiated close to 120 lawsuits against firms it claims are unlawfully selling its drug replicas.

In May 2024, Hims began selling compounded semaglutide and expects to generate at least $725 million in sales during the first quarter of 2025 from all GLP-1 targeted drugs, which include Wegovy, Zepbound, and Lilly's Mounjaro. Its pricing strategy offers compounded semaglutide at roughly one-third of Wegovy’s list price, although these purchases do not count toward insured patients’ deductibles, which can reach thousands of dollars. Patient co-pays can vary, often falling between a fixed amount to a percentage of the approximately $1,000 list price.

Recent agreements from major pharmacy benefit managers, such as Cigna's Express Scripts, have allowed patients to purchase branded Wegovy for a $200 co-pay, targeting the cash-pay demographic. Furthermore, CVS's Caremark PBM designated Wegovy as its preferred weight-loss drug as of July 1, reflecting Novo's lower pricing, aiming to attract health plan clients previously deterred by high coverage costs.

In September, Hims offered compounded semaglutide for as low as $99 a month to eligible individuals. Jailendra Singh, an analyst at Truist, remarked on the importance of providing patients with choices in their healthcare needs to establish a comprehensive service offering.